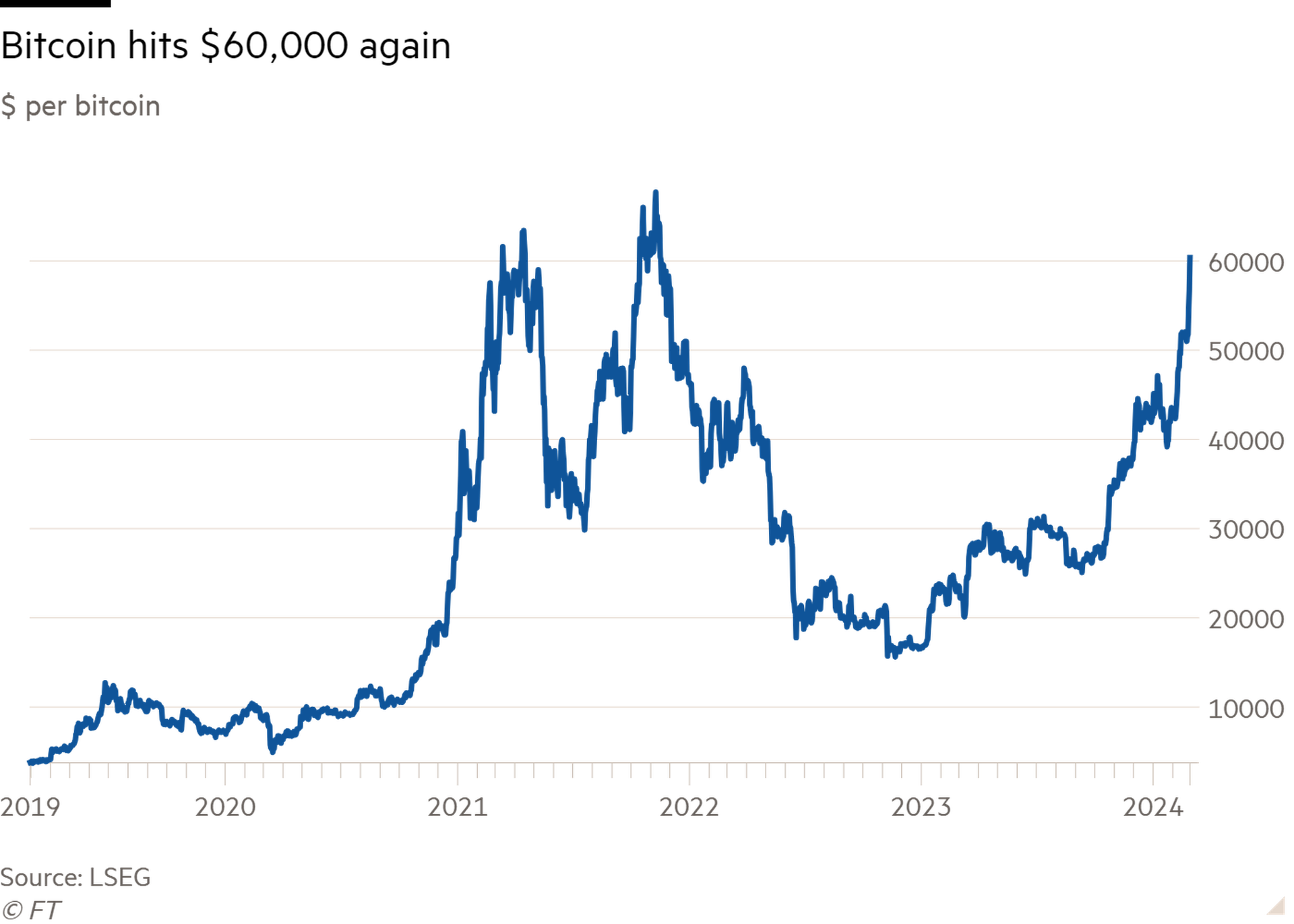

The price of bitcoin has climbed above $60,000 for the first time in more than two years, as a lightning rally puts the world’s biggest cryptocurrency within touching distance of its all-time high.

Bitcoin rose as much as 12.6 per cent to hit $63,968 on Wednesday, before falling back to about $60,000. The rally has brought its gains to 42 per cent in the first two months of this year.

The rapid ascent has revived memories of the crypto bull market that pushed the token to its record peak of nearly $69,000 in November 2021, as investors pile in amid “fear of missing out” on further price rises.

“This is insane,” said Timo Lehes, co-founder of blockchain company Swarm, adding that he expected more money to flow into the token.

“When people see these kinds of increases in a short period of time . . . then it just draws in people and Fomo does kick in,” he said.

In January, US regulators approved the launch of spot bitcoin exchange traded funds by mainstream asset managers including BlackRock and Invesco, paving the way for an influx of new cash from investors looking to speculate on the cryptocurrency through a regulated vehicle. The 11 funds now hold 303,000 bitcoins, according to K33 Research, worth $18bn and equivalent to about 1.5 per cent of the total bitcoin supply.

“We could see the all-time high being broken any day now,” said Simon Peters, an analyst at trading firm eToro. “The driving force behind it is without a doubt the [bitcoin funds].”

The surge in bitcoin price comes amid a wider rally in traditional financial markets. Chipmaker Nvidia’s blockbuster results have fed an investor frenzy over the potential of artificial intelligence technology, helping push US and European stocks to all-time highs in the past week.

Crypto trading platform Coinbase blamed traffic that was 10 times normal for disruptions to some users, including displays of a zero balance in their accounts.

“We appreciate your patience,” Coinbase said. “We’re beginning to see improvement in customer trading. Due to increased traffic, some customers may still see errors in login, sends, receives and with some payment methods. Rest assured your funds are safe.”

The price of bitcoin has soared despite US regulators’ clampdown on the biggest crypto companies and continued scepticism about the token. Last week, European Central Bank officials lambasted the cryptocurrency, saying “the fair value of bitcoin is still zero”.

“For society, a renewed boom-bust cycle of bitcoin is a dire perspective. And the collateral damage will be massive,” they wrote, adding that the token’s price “is not an indicator of its sustainability”.

The crypto industry has been boosted by the belief that it is moving on from the scandals of recent years. The Securities and Exchange Commission hit Binance, the world’s biggest crypto exchange, with a record $4.3bn fine in November for crimes including failing to protect against money laundering and breaching international sanctions.

Binance’s rival, FTX, collapsed in 2022 and its founder Sam Bankman-Fried was found guilty on seven charges of fraud and money laundering. This week, his legal team argued for the former crypto tycoon to spend just a few years in prison, rather than the 100-year sentence he could face.